ontario ca sales tax 2021

Average Sales Tax With Local. Follow us on Facebook.

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Learn about retail sales tax on private purchases of specified vehicles and on certain premiums of insurance and benefits plans.

. The minimum combined 2022 sales tax rate for Ontario California is. Form ON-BEN - Application for the 2022 Ontario Trillium Benefit and Ontario Senior Homeowners Property Tax Grant. Sellers are required to report and pay the applicable district taxes for their taxable.

Industrial Hydro - VacantExcess Land. What is the sales tax rate in Ontario California. The 775 sales tax rate in Ontario consists of 6 California state sales tax 025 San Bernardino County sales tax and 15 Special tax.

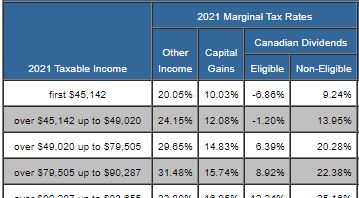

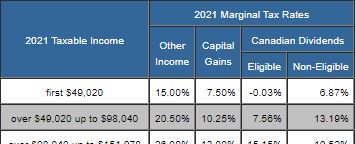

THE CORPORATION OF THE VILLAGE OF SOUTH RIVER. I1 Final tax rate. Ontario Personal Income Tax Brackets and Tax Rates in 2021.

1 Ontario still has retail sales tax RST on insurance and on private sales of used motor vehicles. Select the California city from the list of popular cities below to see its current sales tax rate. The Corporation of the Town of Cochrane.

The California sales tax rate is currently. Some areas may have more than one district tax in effect. The County sales tax rate is.

Schedule ON479A - Ontario Childcare Access and Relief from Expenses CARE Tax Credit. Books newspapers and magazines. The following tax data rates and thresholds are used in the 2021 Ontario Tax Calculator if you spot and error or would like additional tax calculations integrated into the 2021 Ontario Tax Calculator then please contact us.

The following goods and services are exempt from the PST in BC. Local time on Thursday September 30 th 2021 at the Municipal Office 171 4 th Ave Cochrane Ontario P0L 1C0The tenders will then be opened in public on. Lowest sales tax NA Highest sales tax 1075 California Sales Tax.

Find out about Upcoming Tax Sales and Sales of Land for Tax Arrears in Oshawa Ontario Canada. SALE OF LAND BY PUBLIC TENDER. Take Notice that tenders are invited for the purchase of the land described below and will be received until 3.

Napanee ONÂ Â K7R 3L4. With local taxes the total sales tax rate is between 7250 and 10750. Ontario Sales Tax Credit This credit provides sales tax relief to low- to moderate-income tax filers.

The credit for the 202122 benefit year provides up to 316 in annual relief for a single eligible person and up to 316 per eligible adult and child in a family. The Ontario sales tax credit OSTC is a tax-free payment designed to provide relief to low- to moderate-income Ontario residents for the sales tax they pay. Did South Dakota v.

California has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 35. Businesses which sell taxable goods andor services in each province are required to register as a vendor to collect the provincial retail sales tax where applicable. Sales Taxes in Ontario Ontario is one of the provinces in Canada that charges a Harmonized Sales Tax HST of 13.

PT Final tax rate. Schedule ON428A - Low-income Individuals and Families Tax LIFT Credit. Industrial Hydro - New construction.

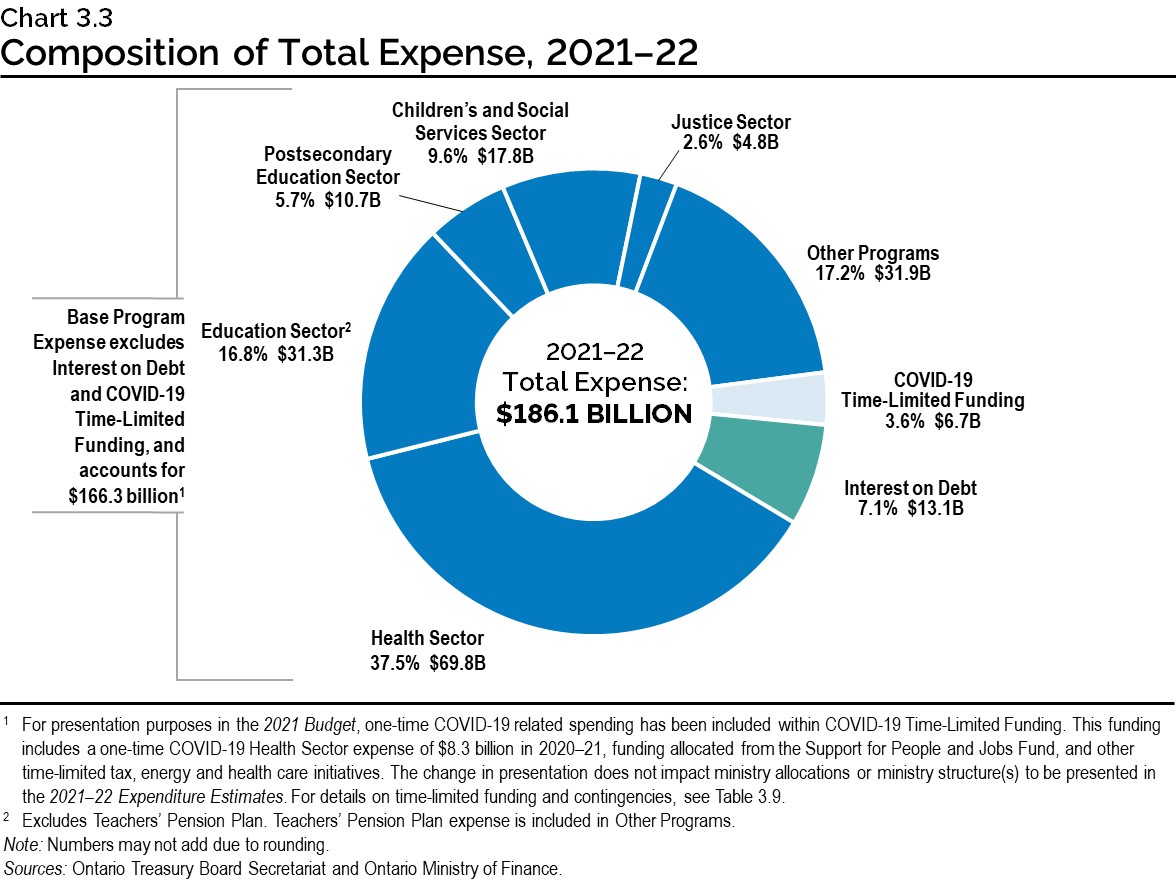

Industrial - Farmland Awaiting Development. Over the medium term the government is projecting steadily declining deficits of 331 billion in 202122 277 billion in 202223 and 202 billion in 202324. Serving Tax Sales Investors Since 2005.

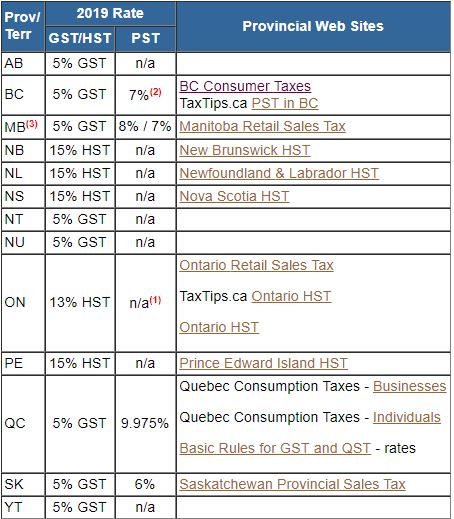

California has recent rate changes Thu Jul 01 2021. 15 rows 5 GST. 1788 rows California City County Sales Use Tax Rates effective April 1.

Basic groceries and prepared food. IH Final tax rate. 175 lower than the maximum sales tax in CA.

IJIK Final tax rate. Sale of land by public tender. The HST is applied to most goods and services although there are some categories that are exempt or rebated from the HST.

Follow us on Twitter. The statewide tax rate is 725. Municipal act 2001.

For payments based on your 2021 income tax and benefit return July 2022 to June 2023 the program provides a maximum annual credit of 324 for each adult and each child in a family. When combined with the 5 GST you pay a total of 12 sales tax on most goods and services. JH Notional tax rate.

If rainy weather conditions exist on either Friday or Saturday of the designated weekend garage or yard sales may be conducted on the following consecutive Friday Saturday and Sunday. Ontario taxes and COVID-19. The provincial sales tax PST in BC.

2022 List of California Local Sales Tax Rates. There is no applicable city tax. The Ontario sales tax rate is.

This is the total of state county and city sales tax rates. But it has also had a significant impact on public finances. You can print a 775 sales tax table here.

Schedule ON S2 - Provincial Amounts Transferred from your. Sales Tax in British Columbia. Serving Tax Sales Investors Since 2005.

For questions please contact the Community Improvement Department at 909 395-2007. Ontarios deficit is projected to increase from 87 billion in 201920 to 385 billion in 202021. Our team has assisted municipalities across Ontario with tax sale.

Wayfair Inc affect California. In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. Take notice that tenders are invited for the purchase of the lands described below and will be received until 300 pm.

Visit wwwcragcca or call 1-800-959-8287. See the link to Ontario Retail Sales Tax for more information. See Details 18 13 060 030 06314 0000 Location.

Tax Sales Hub Investments. This online book has multiple pages. Retail sales tax RST is charged on.

View All By Date. Those district tax rates range from 010 to 100.

Canada Sales Tax Gst Hst Calculator Wowa Ca

Taxtips Ca 2021 Sales Tax Rates Pst Gst Hst

Taxtips Ca Ontario 2020 2021 Personal Income Tax Rates

Can You Claim Rent In Ontario Ontario Trillium Benefit 2021 Turbotax

Taxtips Ca Business 2020 Corporate Income Tax Rates

Taxtips Ca Canada S Federal 2020 2021 Personal Income Tax Rates

How Much Tax Will You Pay On Used Cars In Canada Filing Taxes

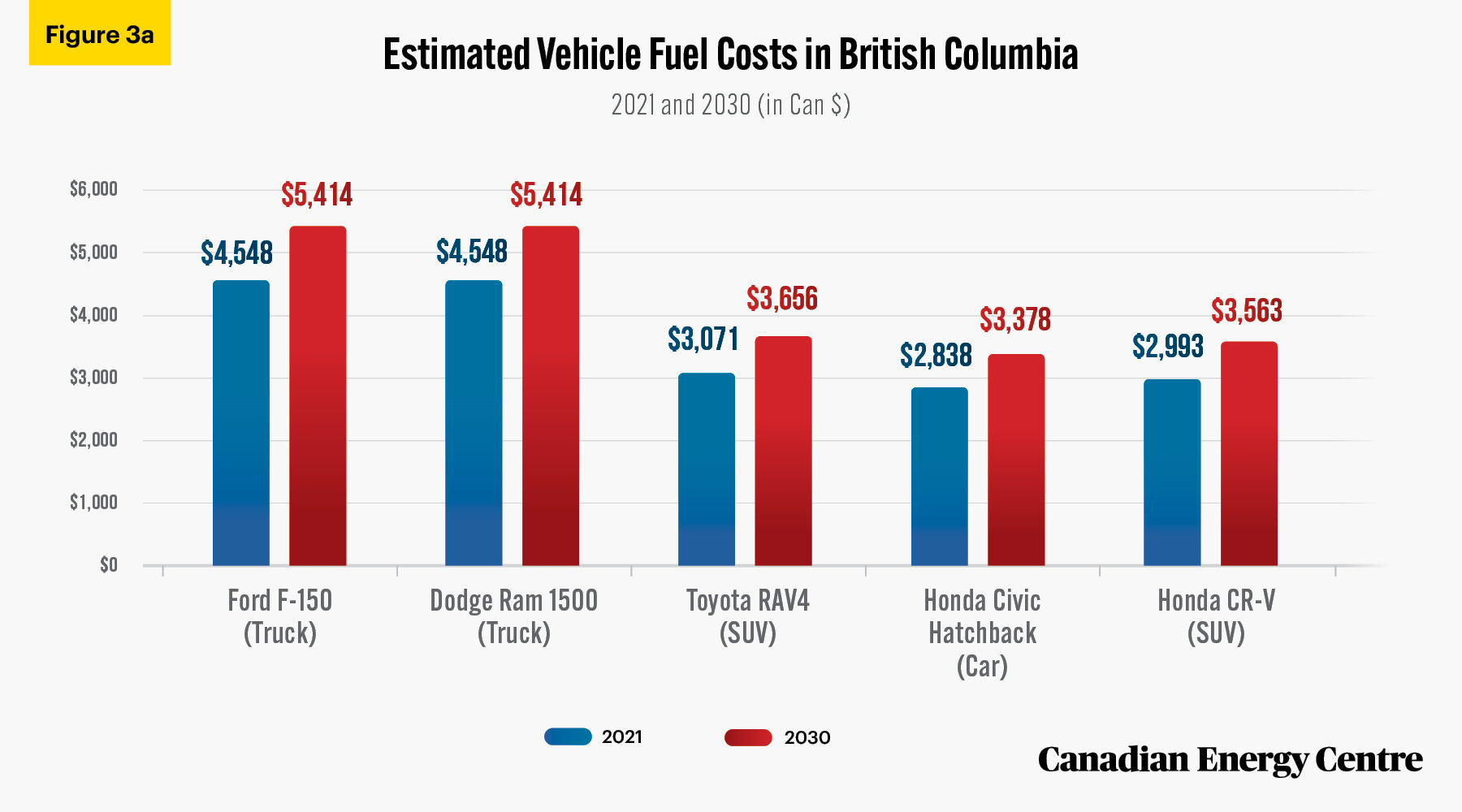

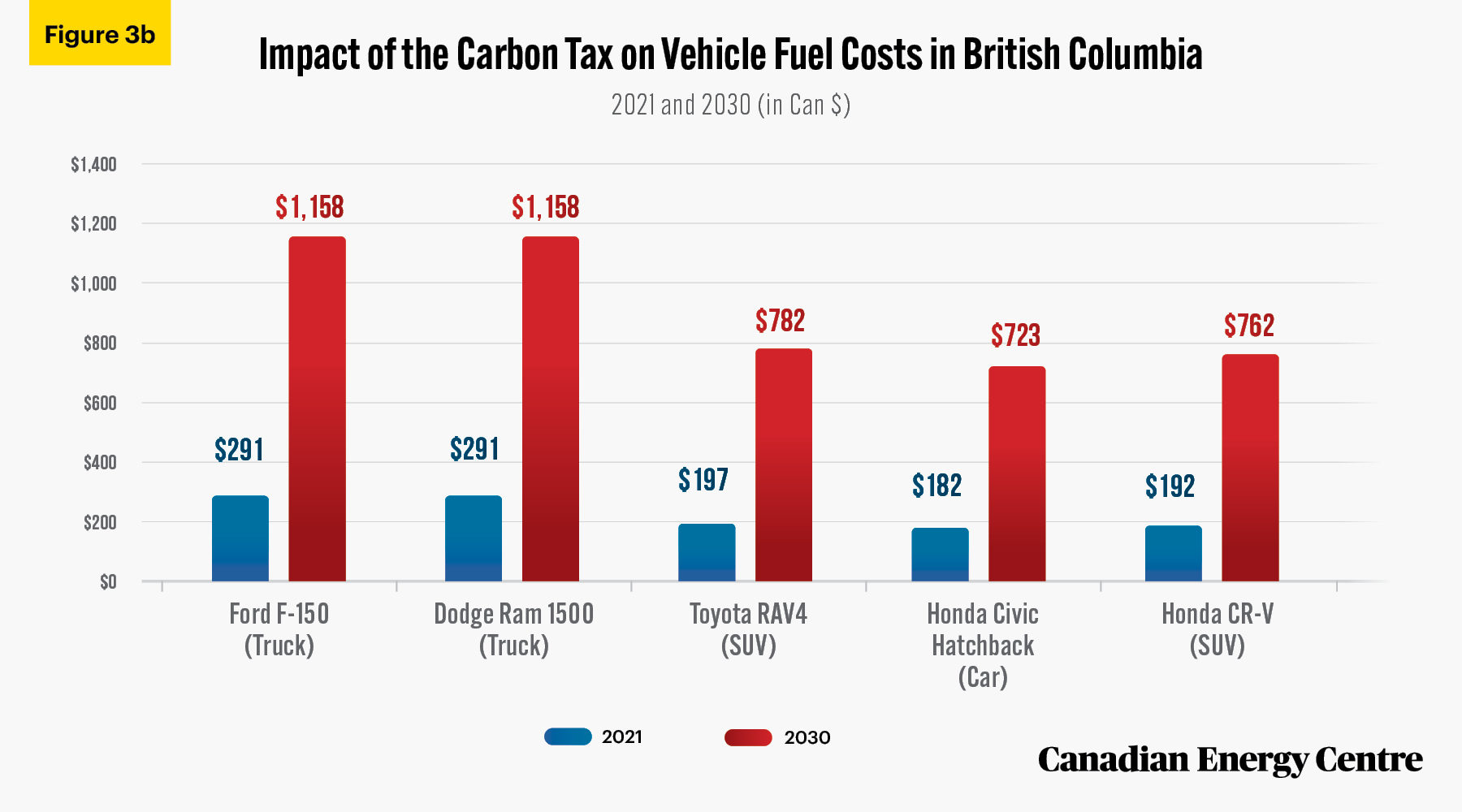

Up To 350 Per Cent Higher At The Pump By 2030 The Impact Of Higher Carbon Taxes On Gasoline Prices Canadian Energy Centre

Personal Income Tax Brackets Ontario 2021 Md Tax

Up To 350 Per Cent Higher At The Pump By 2030 The Impact Of Higher Carbon Taxes On Gasoline Prices Canadian Energy Centre

Taxtips Ca Ontario 2019 2020 Income Tax Rates

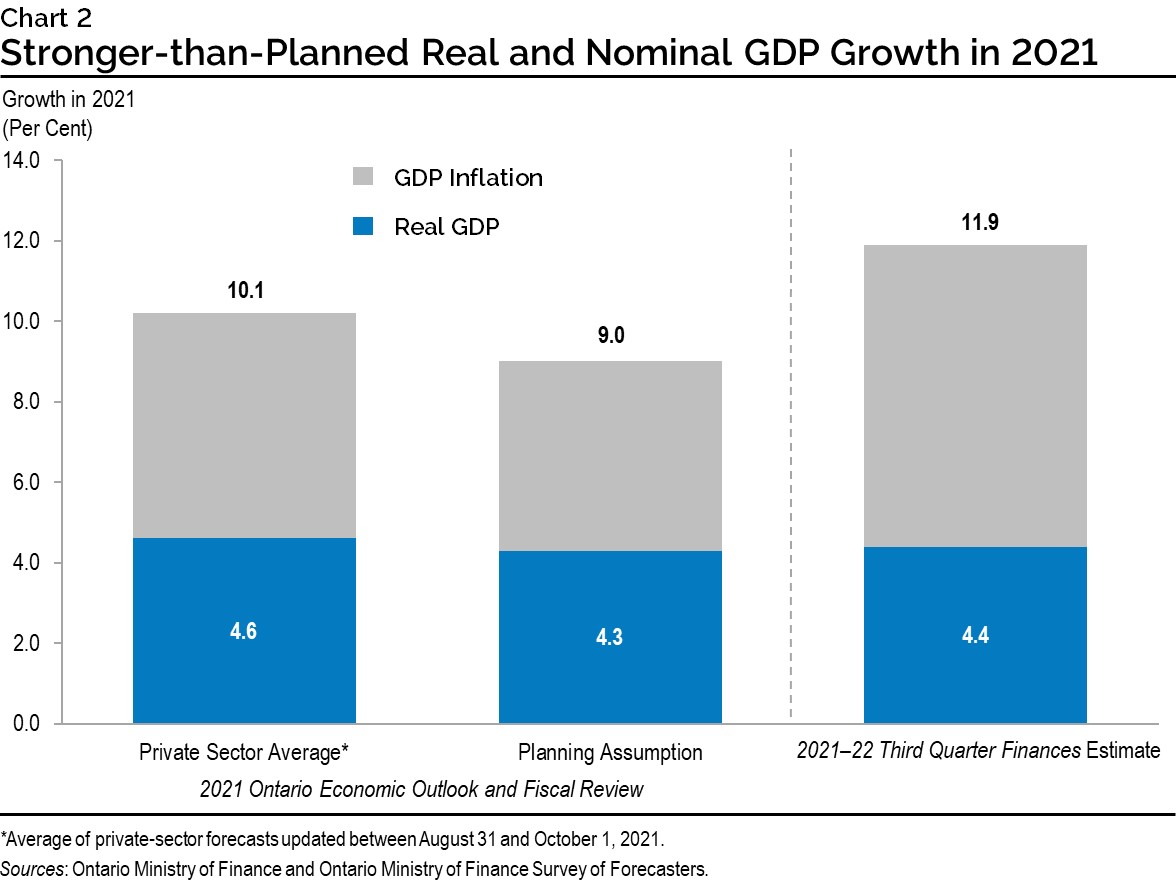

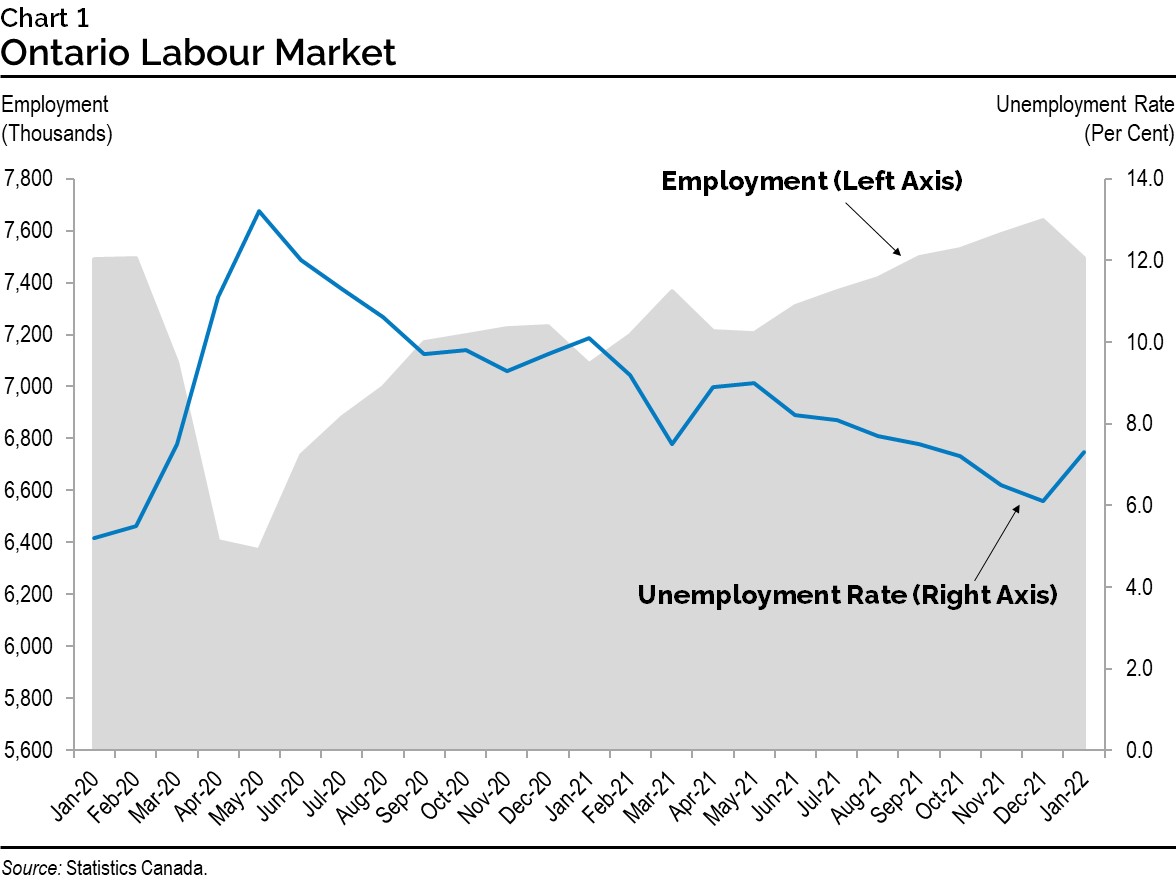

2021 22 Third Quarter Finances Ontario Ca

Consumption Taxes In Canada Revenue Rates And Rationale Hillnotes

2021 22 Third Quarter Finances Ontario Ca

Taxtips Ca 2019 Sales Tax Rates For Pst Gst And Hst In Each Province